Save It For The Suite Life

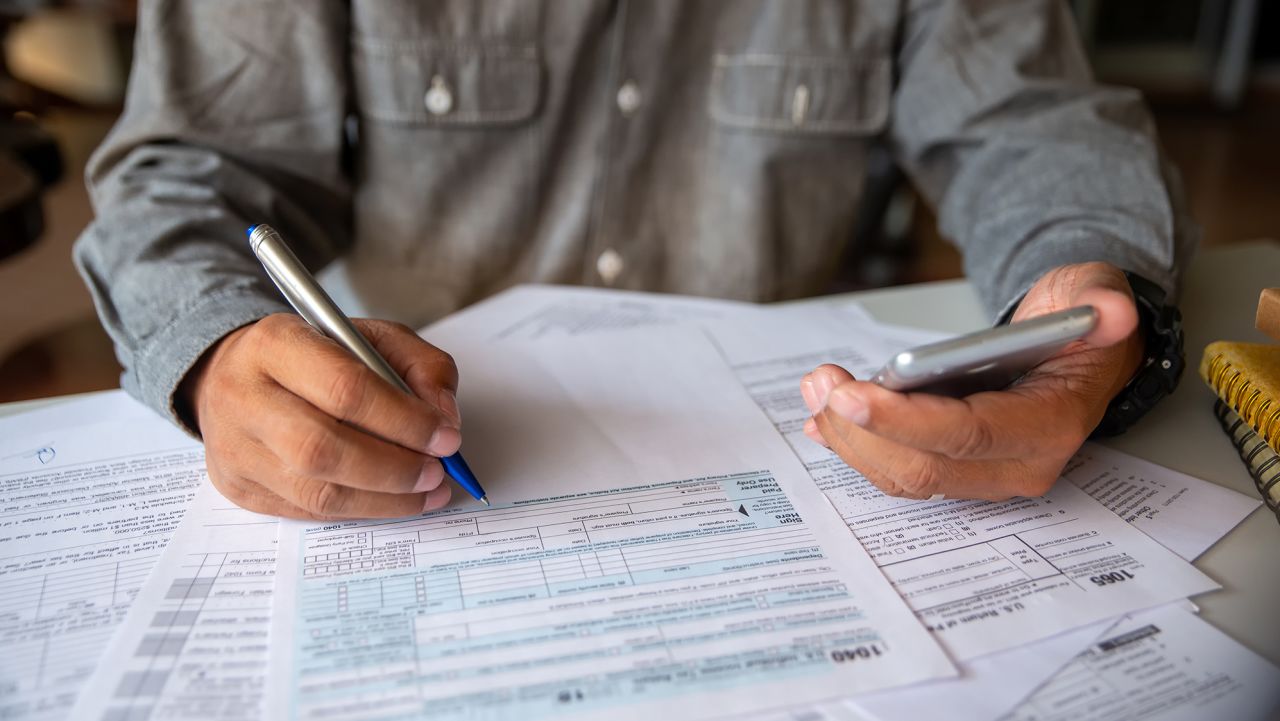

Imagine being fearless with your finances, comfortably handling your business expenses, and seeing deductible opportunities as they arise

Savvy and Suite is a bespoke Tax & Accounting firm with a special focus on tax strategies that save business owners thousands of dollars in taxes each year!

Purposeful Tax Planning

We help you keep more money in your pocket so that you can invest in the most exclusive commodity... time freedom.

Our Collection Of Services

For All Of Your Financial Essentials

Not sure which service is right for you? Contact us, and we’ll help you find the perfect fit!

Latest Stories

O:LIVE BOUTIQUE HOTEL- A LUXURIOUS STAY IN PUERTO RICO’S TRENDIEST AREA

Just a 10-minute drive from Old San Juan and walking distance to the beach, the experience guests walk away with after a stay at this exquisite hotel is nothing short of wonderful. Despite its luxury stature, you actually feel quite at home.

PUBLIC HOTEL- AN INSIDE LOOK AT LOWER EAST SIDE’S NEW TRENDY HOTEL

Step into Ian Schrager’s world through his new uber modern Public Hotel. The man who brought New York some of its favorite hot spots, like The Hudson Hotel and that little old place known as Studio 54, is back in action with this trendy Lower East Side hotel. Known for his stylish hotels sans the hefty price tag, his latest Christie street hotel doesn’t disappoint.